It solely takes one counterexample to disprove a mathematical theorem. The identical applies in finance. This makes counterexamples notably helpful for buyers. In earlier posts, I mentioned Bitcoin as a doable counterexample to the environment friendly market speculation that market value all the time displays elementary valuation. My argument was that Bitcoin had primarily no elementary worth and but was buying and selling so excessive at $20,000 a share. coin. For fairness buyers, a extra direct instance is the latest habits of Tilray, the Canadian marijuana firm. The issue just isn’t that Tilray has no elementary worth – it clearly does. The issue is that the market can not seem to decide what the basic worth is, even from minute to minute.

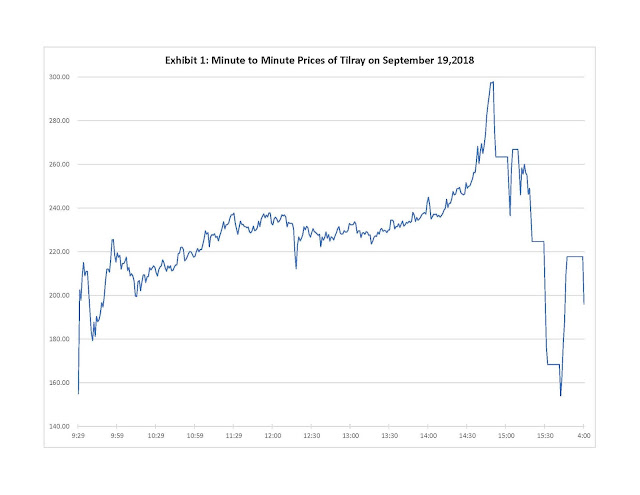

As an example the purpose, Exhibit 1 plots the minute-by-minute value of Tilray (with respect to Jap Time) throughout buying and selling on September 19, 2018. The closure on September 18 is included as the primary commentary. The factors the place the road crashes and bounces again up are buying and selling stops. Because the exhibit exhibits, there have been 5 buying and selling halts throughout the day.

As proven, Tilray closed at 154.98 on September 18. Inside 10 minutes of buying and selling on September 19, it had risen extra the 25% to round 215. It then surged in herky-jerk vogue as much as practically 300, practically double yesterday’s shut. At its peak, the market capitalization was practically $30 billion. Round three Jap time, the worth started to say no, though the decline was interrupted by 5 buying and selling halts. Lastly, the inventory closed at 196.04, down greater than 30% from the day’s excessive, however nonetheless up practically 25% from yesterday’s shut. Quantity for the day was 31.7 million shares – in comparison with shares excellent of 76.5 million and a public share of 17.8 million.

Whereas all this motion was happening, there was no launch of any primary data

Whereas all this motion was happening, there was no launch of any primary data

After all, Tilray is an excessive instance, however its existence means that there are all the time important mispricings lurking on the market. The inventory couldn’t have been pretty valued at $150 and $300 on the identical day with out the discharge of elementary data. The onerous half is figuring out and exploiting mispricing.

For instance, within the case of Tilray was it too low-cost at $150 or too costly at $300? Or possibly it was overpriced in each circumstances? The one strategy to determine is with a primary valuation mannequin.

For instance, within the case of Tilray was it too low-cost at $150 or too costly at $300? Or possibly it was overpriced in each circumstances? The one strategy to determine is with a primary valuation mannequin.